Congratulations Brother Colin and Sister Ivy on your Blessed Christian wedding.

Such a blessing to have attended your wedding service, Amen.

Through the Highways of Globalization

Congratulations Brother Colin and Sister Ivy on your Blessed Christian wedding.

Such a blessing to have attended your wedding service, Amen.

Diaspora sensibilities create a third space, neither homeland as one had left it nor the clean global modernity of the host land. Migration infrastructure at every corner which caters to the person from afar.

Learning under the auspices of the legend since early 2015.

Mohsin Da, is an inspiration. One does not need the h index gymnastics to do real work for three decades, yet I am not seen a person who is such a profound thinker of the life worlds of Bangladeshi migration in SE Asia.

Thank you for everything, grateful.

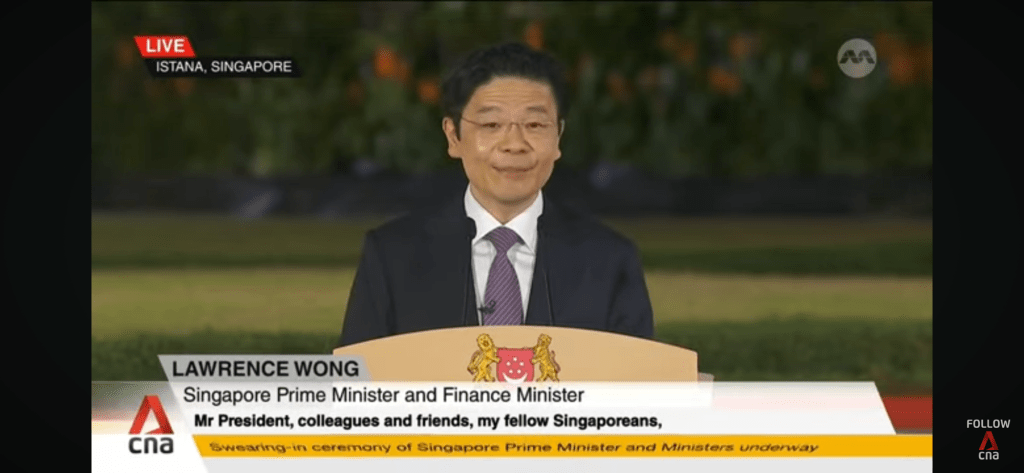

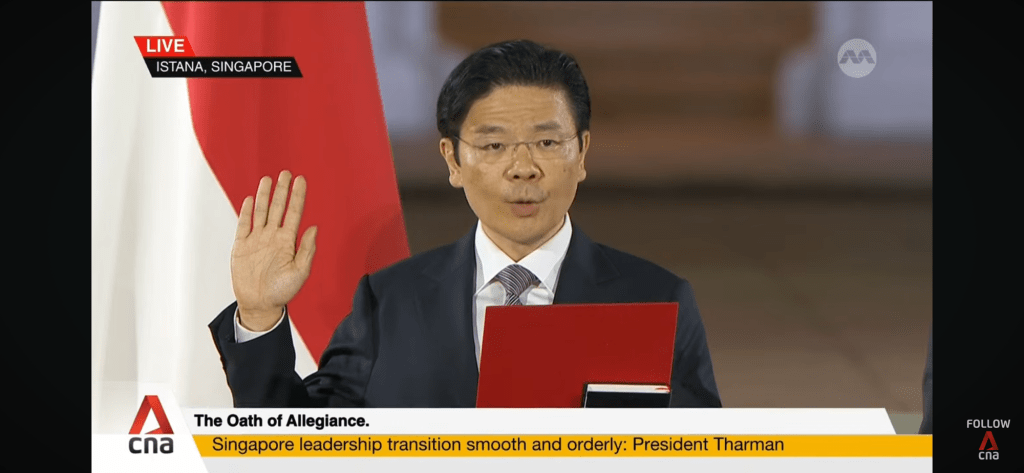

History this evening in Singapore, as PM Lawrence Wong takes charge in a very clinical Singapore- esque transition of power which has been in works since the past election.

Senior Minister Lee will be in the cabinet with President Tharman around as Head of State. The legends will be around for a few more years for counsel and global diplomacy.

PM Lawrence Wong in his speech calls for a renewed social contract with a globally aware citizenry and an aging population. He reiterated the tough geopolitical climate, and there are reasons for worry, with the US elections up ahead.

As a product of the system, and having read graduate school coursework at both NUS and NTU on NRF and SSHRC scholarships linked to policy research projects, Singapore is my second home, and one of the few regular Indian watchers of affairs in the tiny red dot, I wish the new Prime Minister well.

Majulah 🇸🇬

ESG is an assemblage of risk (an actor network) which many vectors, the primary variables which crystallise into Climate Risk, Human Rights Risk and Biodiversity Risk, and these have ramifications for litigation, which is the real risk no ones wants to bring to the conversation.

The Indian High Commissioner to Malaysia spoke to its citizens who are students in a reception at the Netaji Subhash Chandra Bose Indian Cultural Centre. He spoke eloquently on Indian student community globally that stands at 1 million plus, and that Indian Student numbers will only increase in Malaysia given the Canada draw down. There are 17 million Indians in the diaspora. Malaysia has 4400 Indian students in the country. Students were raising their concerns and the HC was proactive, a signature of the Jaishankar era of Indian foreign policy and diaspora engagement. There are 24000 Indian Professional expats in Malaysia.

Met fellow Indians in Malaysia and my university, even my department at the reception.

It brought a tear to my eye, when the HC mentioned welcome home, this is your space. Jai Hind.

With my migration mentor from Singapore, Mohsin Dada who showed me the lifeworlds of migrant workers from a close way and revealed the hypocrisy of civil society, and true value of human dignity. Family, truly.

Discussing Singapore and the region over a soft drink and sheesha at a Arabic place in Bukit Bintang is a joy, not surpassed by not a lot more.

I still write on the lifeworlds of migration in the Indian Ocean Region, and no academic or activist’s cancelling or gatekeeping can deter a migrant to write.

We are made of sterner stuff.

Brickfields- History is etched in the urban.

Diaspora sensibilities have their own articulations. The Punjabi migrant worker selling masala chai is unmistakable. The photo of Swami Vivekananda in the flower shop next to the Kovil, and the realisation that history does not need to be performed, yet heritage has a tourist dollar value. The modern towers and office blocks share a historic terrain which the glass tower might not recognise, as the intangible cultural significance is hardly captured on a balance sheet.

The Ganesh Temple which shares its neighbourhood with three Hyderabadi biryani places and an Andhra Church nearby shows a part of Brickfields which is from current day coastal Andhra, and not Tamizh. The Sai Baba mandir with the two Sai Baba’s from Shirdi and Puttaparthi, and the Kailash Mansarovar pilgrimage poster in the same vicinity, depicts a global Hinduism, which is key to the idea of India from the diaspora.

The multiplicity of faith institutions in the enclave and the sheer density of it makes it global, from a Vihara to a Methodist Church.