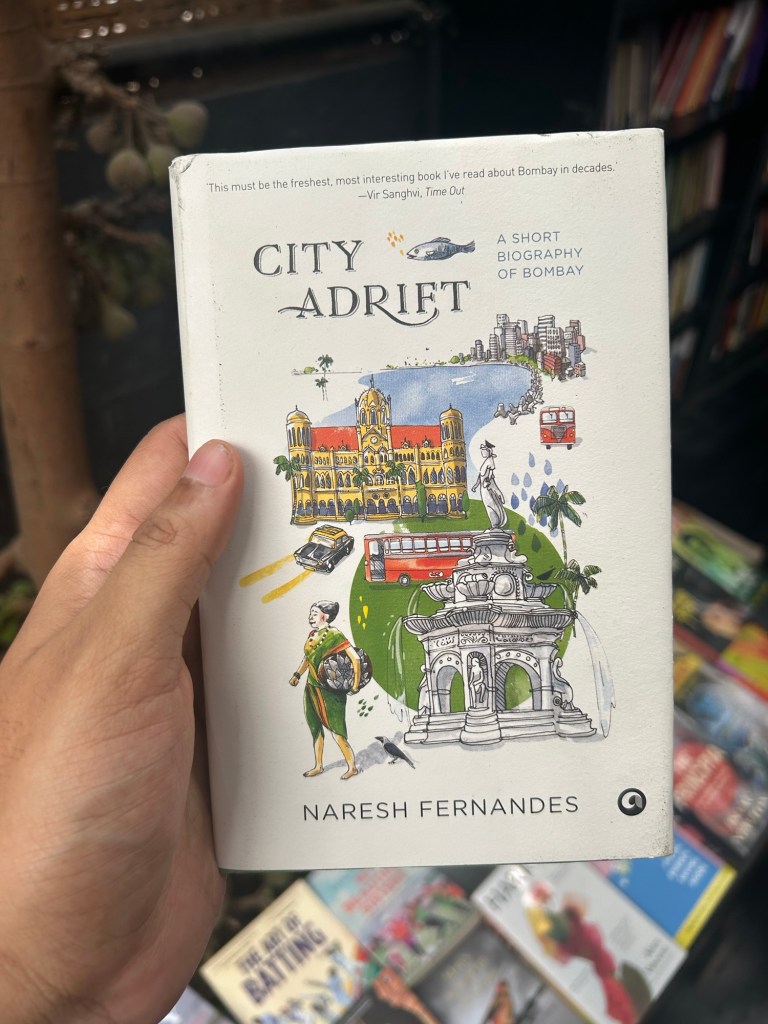

The city has fractals

History and Hustle jostle for elbow room

Is Hustle the History of a Migrant City

An ode to Ambition

Or a space for survival

Through the Highways of Globalization

The city has fractals

History and Hustle jostle for elbow room

Is Hustle the History of a Migrant City

An ode to Ambition

Or a space for survival

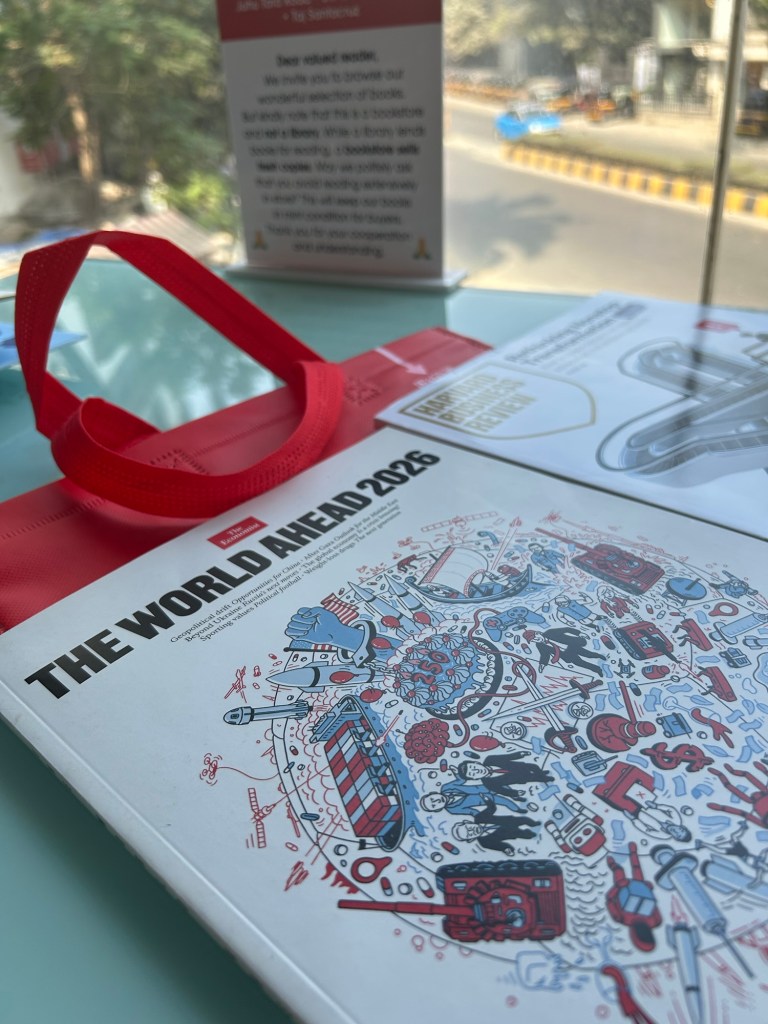

‘We live in an era of geopolitics’

If one hears what Marco Rubio says about climate red tape at his address at the Munich Security Conference, with AI and Data Centres, energy is back to the table. Even EVs need energy to be charged which is not necessarily renewable.

Sustainability needs to speak to this reality, rather than through a stack of frameworks at every mention of anything remotely green or any shade of green.

A lot of communities still don’t have steady power access in the borderlands in SE Asia, hence plenary politics needs to be in conversation with local needs.

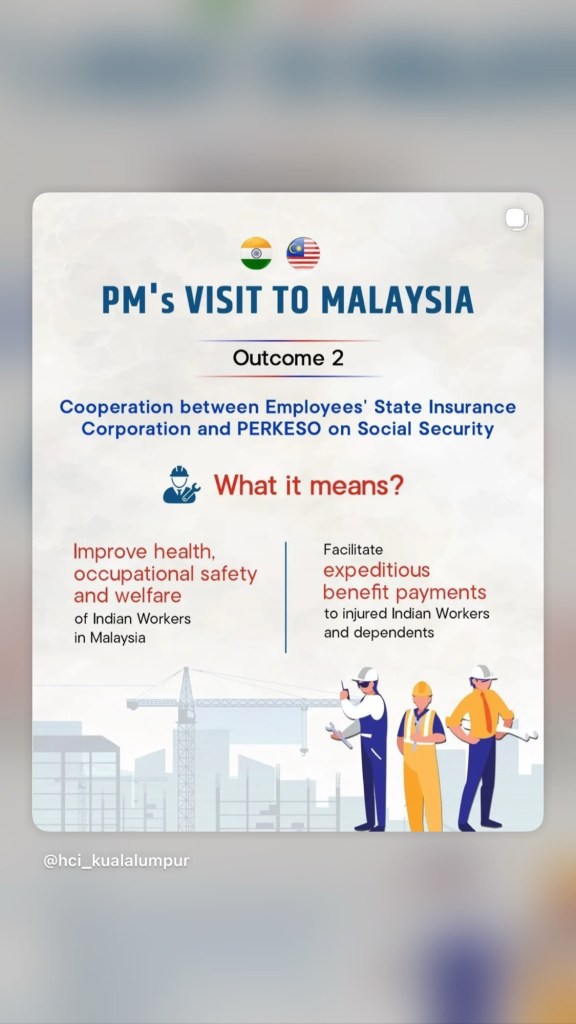

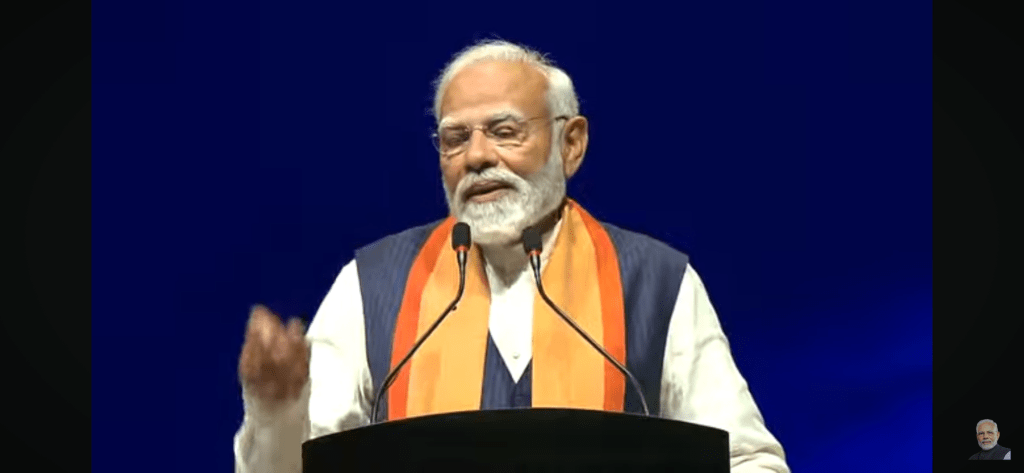

This is the most important development for me personally from Modi ji’s visit to Malaysia, as a long time advocate of transnational social protection for migrant workers. Linking social security in the host and destination countries in the labour migration corridor is needed.

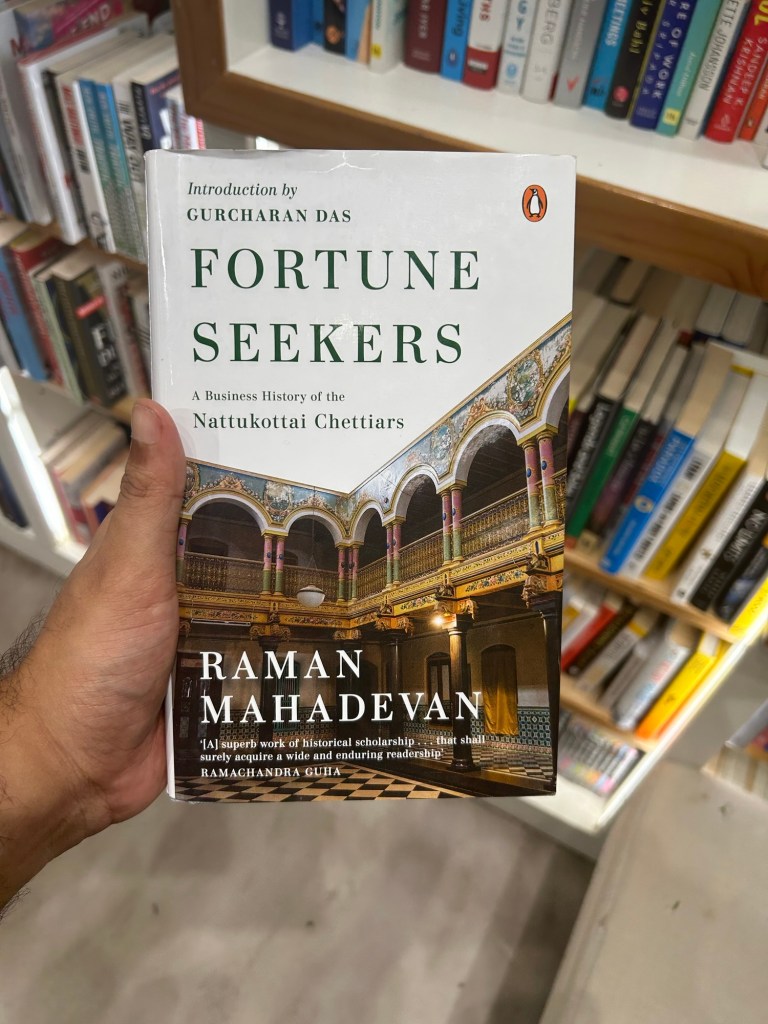

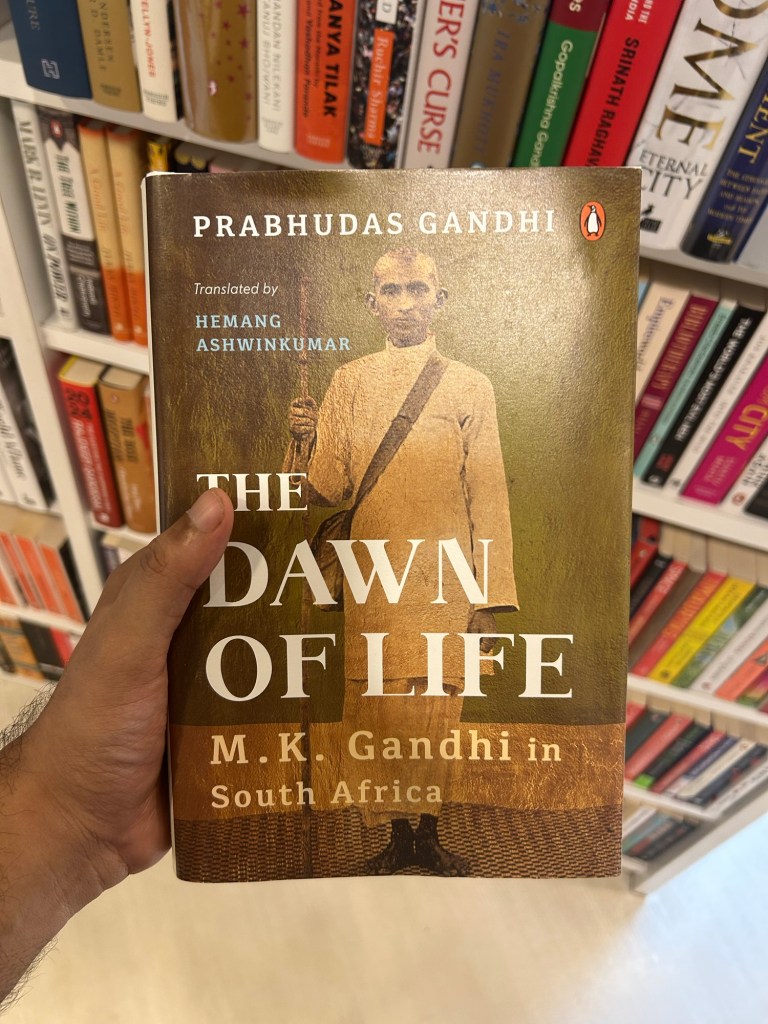

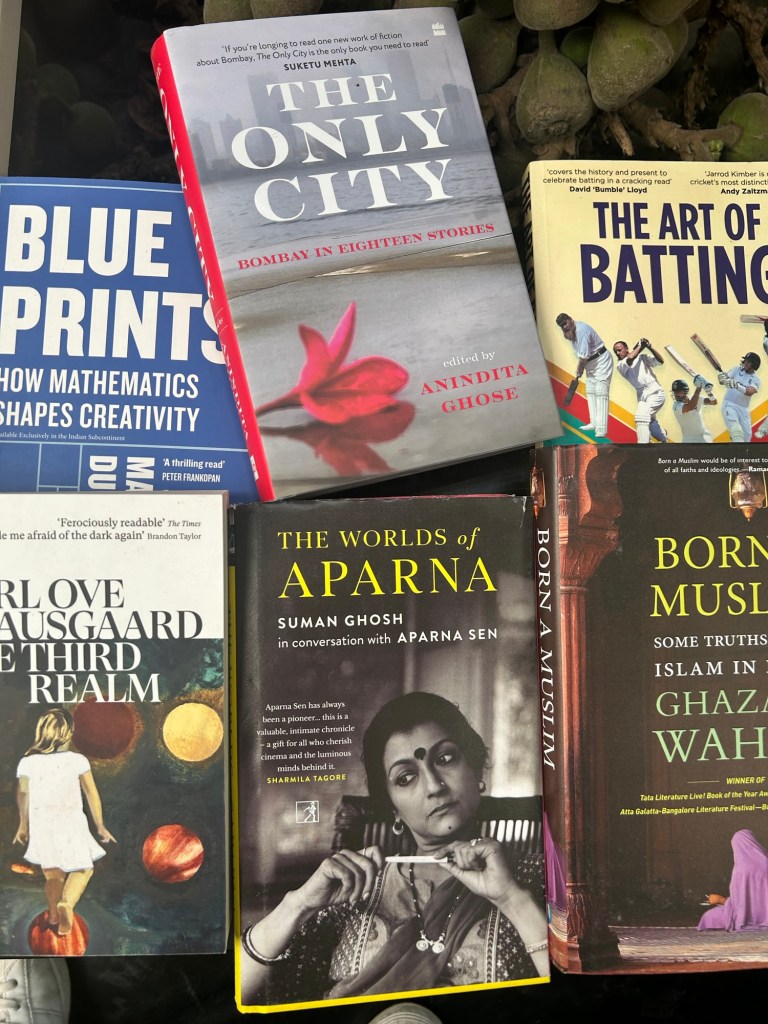

The Bombay Book Store Crawl.

Prithvi Theatre Book Store- great for art and cinema books

Granth Book Store, Juhu – global magazine and book collection

White Crow, Jio World Drive – strong food book collection

Modi ji in Kuala Lumpur in his address to the diaspora ticked all the right boxes, roti canai, teh tarik, Netaji, Azad Hind Fauj, Tiruvalluvar chair at UM, movies, heritage etc. Modi ji in my rather deep interactions in Malaysia is popular with the Hindu Diaspora, and he paid homage to this very community in the address.

Modi ji called for more Malaysians to visit India in particular the Malay Muslim community, for greater people to people ties. India has a definite cache thanks to its large diaspora, but more needs to be done with larger investments in watering the goodwill.

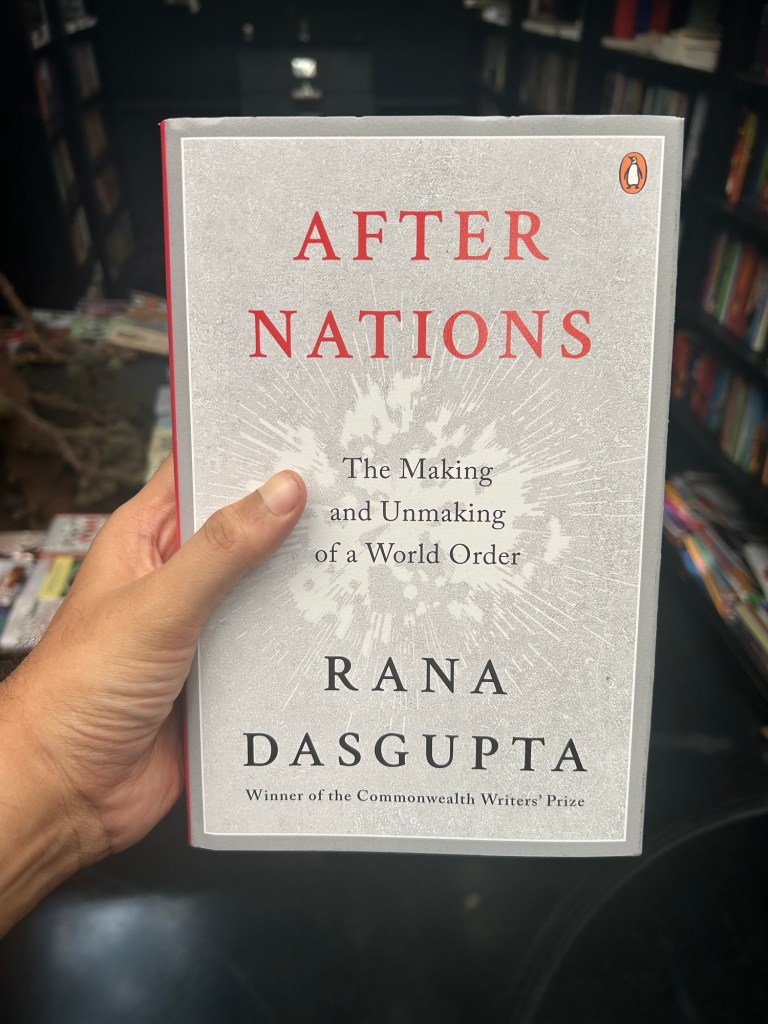

We write all the time, for work and regular communication in daily life, but we hardly take a class in writing ever. I am an engineer who always wrote but never ever took a class in writing. An MFA was never on the radar, so one made a reading list, such as this one. An important reference on the tactics of writing.

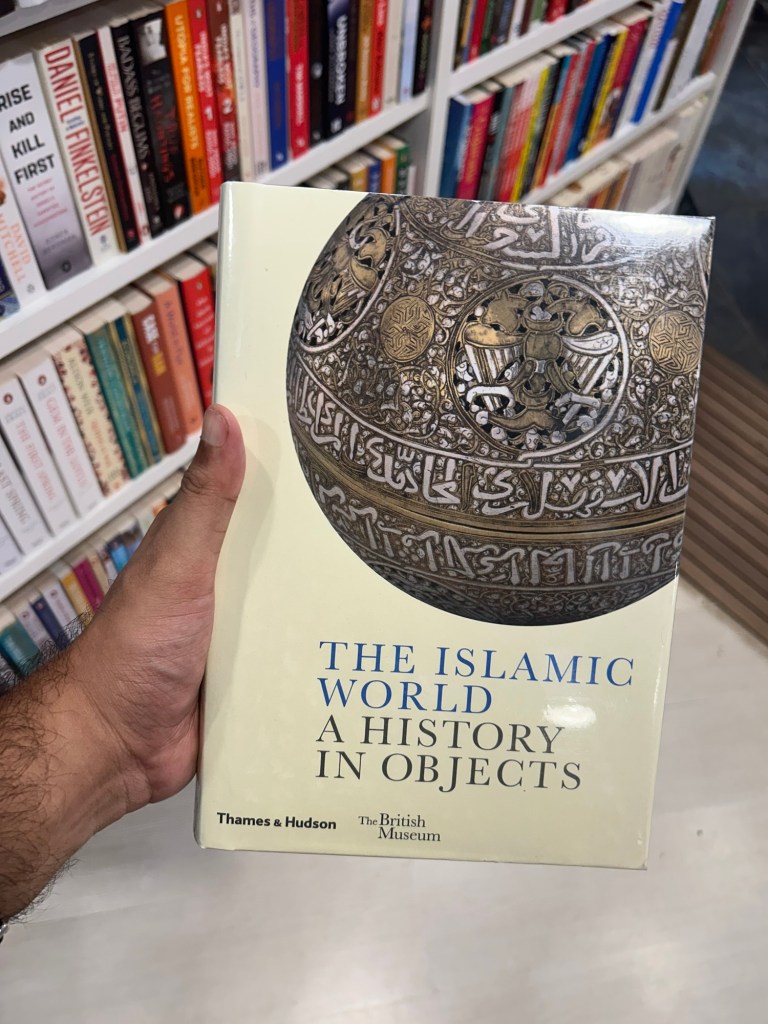

At the Infosys Science Foundation’s event at the majestic Asiatic Society in Mumbai with Harvard PhD Candidate, Mohit. Professor Kooria speaks of stories as indigenous sources. Dr. Amitav Ghosh generously cites Professor Bishara’s work, Sea of Debt and Monsoon Voyagers as examples of innovative histories. He provokes Indian Ocean historians to work with other miracle stories, especially from Indonesia. Sparkling and Imaginative, beyond the h-index hegemony.

The trouble with ESG compliance and real problems (read air pollution, waste management etc) is the detachment with the politics of public health and the disclosure which is risk based, but risk for whom? The investor, community or the government?

Unless environmental issues matter at the ballot box, what will corporates, disclose? Zilch.

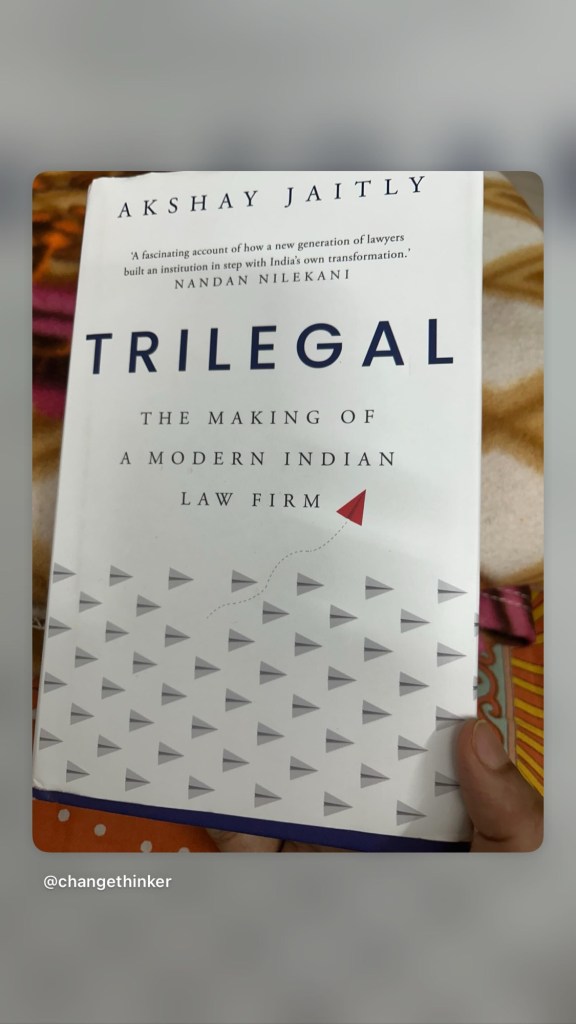

Such a brilliant book, swallowed this read on professional services venture building in two days. As a consulting venture builder who has gone from minus one to one, this book spoke to me loud and clear. I wish i had read this a decade ago.

Trilegal: The Making of a Modern Indian Law Firm by Akshay Jaitly is a must read for any professional in the professional services space, the why, the how and the what of building through innovation and integrity.

The ‘End of History’ has clearly not ended. The Great Power Games have returned, and how we structure purchases in an era of great volatility, which is the act of inducing deliberate disorder and chaos, will be a reality.

We are in year two of the age of hot wars: Ukraine, Sudan, Gaza and now Caracas show that wars are a tool of necro-capitalism, as Klein and Zizek had written many years back. With Taiwan and Greenland (read AI and Critical Mineral Value Chains) joining the proverbial war zone, the global economy is up for turbulent headwinds.

We are in the Age of Entropy. The playbooks since 1991 have been torn.